Why Business Owners Prefer Offshore Finance Centres for Startups

Why Business Owners Prefer Offshore Finance Centres for Startups

Blog Article

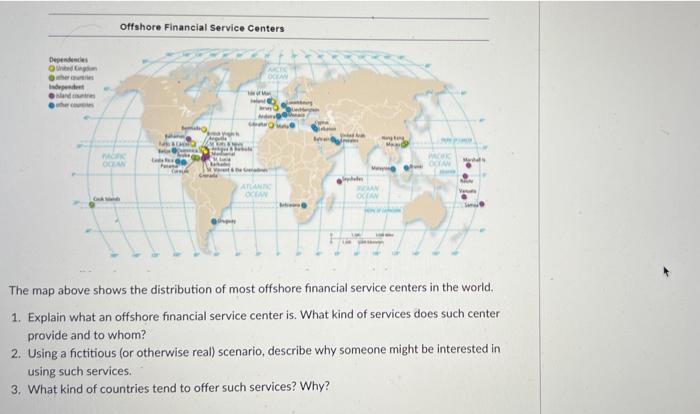

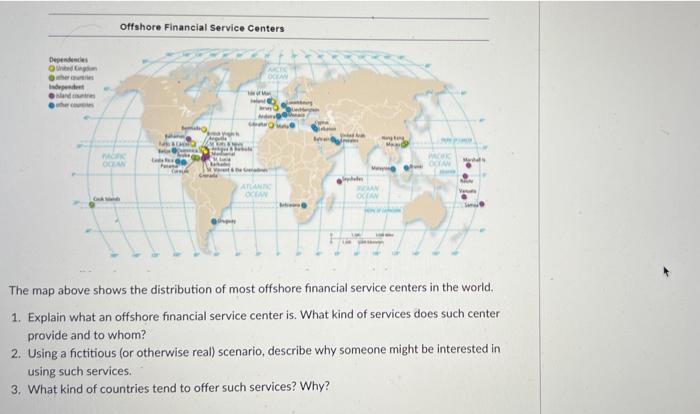

The Impact of Offshore Money Centres on International Service Operations and Conformity

Offshore Money Centres (OFCs) have come to be essential in shaping international service operations, supplying special advantages such as tax obligation optimization and regulative flexibility. The enhancing international emphasis on conformity and transparency has actually presented a complex range of obstacles for companies looking for to take advantage of these centres - offshore finance centres. As companies navigate this double fact of chance and analysis, the implications for calculated planning and operational honesty become significantly pronounced. Comprehending just how to balance these aspects is crucial, yet lots of companies are left questioning exactly how ideal to adapt to this progressing landscape. What approaches will emerge as one of the most effective?

Comprehending Offshore Financing Centres

Offshore financing centres (OFCs) work as crucial centers in the global economic landscape, facilitating international company transactions and investment chances. These territories, commonly identified by positive regulative atmospheres, tax rewards, and confidentiality laws, attract a diverse selection of economic solutions, consisting of insurance, investment, and financial monitoring. OFCs allow businesses to maximize their monetary operations, handle risk better, and achieve better flexibility in their economic techniques.

Normally located in areas with reduced or no tax, such as the Caribbean, the Network Islands, and certain Oriental regions, OFCs offer a lawful framework that enables firms to operate with family member convenience. They typically have durable economic infrastructures and a strong focus on discretion, which attract high-net-worth individuals and multinational firms looking for to protect their possessions and get to global markets.

The operational structures of OFCs can differ significantly, influenced by regional laws and international compliance requirements. Comprehending the distinct attributes of these centres is essential for services seeking to browse the intricacies of international financing (offshore finance centres). As the worldwide financial landscape advances, OFCs proceed to play a significant function in forming the approaches of businesses operating across borders

Advantages of Utilizing OFCs

Making use of offshore money centres (OFCs) can significantly enhance a firm's financial effectiveness, especially when it involves tax optimization and regulative adaptability. Among the main advantages of OFCs is their capacity to offer favorable tax programs, which can bring about substantial savings on business tax obligations, capital gains, and inheritance tax obligations. By strategically assigning revenues to territories with lower tax rates, firms can improve their overall monetary performance.

Moreover, OFCs frequently present streamlined regulatory environments. This reduced bureaucratic burden can promote quicker decision-making and even more agile company procedures, permitting firms to react promptly to market changes. The regulatory structures in lots of OFCs are developed to attract international investment, providing services with a conducive setting for growth and expansion.

Furthermore, OFCs can work as a strategic base for global operations, making it possible for business to accessibility worldwide markets more successfully. Enhanced privacy measures additionally protect delicate economic info, which can be crucial for preserving competitive benefits. Overall, making use of OFCs can create a much more reliable economic structure, supporting both functional efficiency and calculated business goals in a global context.

Difficulties in Conformity

An additional major obstacle is the progressing nature of international guidelines focused on combating tax obligation evasion and money laundering. As federal governments tighten analysis and boost reporting demands, businesses have to stay dexterous and anchor notified to stay clear of penalties. This demands ongoing financial investment in conformity resources and training, which can stress operational budget plans, specifically for smaller business.

Furthermore, the understanding of OFCs can develop reputational risks. Business running in these jurisdictions may encounter apprehension regarding their intentions, causing potential issues in stakeholder relationships. This can adversely affect client trust fund and investor confidence, additional making complex compliance efforts. Eventually, services have to carefully navigate these challenges to make sure both conformity and sustainability in their global procedures.

Regulatory Trends Influencing OFCs

Current regulatory trends are significantly reshaping the landscape of overseas finance centres (OFCs), compelling businesses to adapt to an increasingly strict compliance environment. Federal governments and global companies are carrying out robust steps to enhance transparency and fight tax obligation evasion. This change has led to the fostering of campaigns such as the Typical Reporting Standard (CRS) and the Foreign Account Tax Obligation Conformity Act (FATCA), which need OFCs to report financial details concerning international account holders to their home territories.

As conformity prices climb and governing analysis intensifies, businesses utilizing OFCs must navigate these adjustments meticulously. Failing to adjust might lead to serious penalties and reputational damage, underscoring the importance of proactive conformity approaches in the evolving landscape of overseas money.

Future of Offshore Financing Centres

The future of offshore finance centres (OFCs) is poised for substantial makeover as advancing regulative landscapes and moving worldwide economic dynamics improve their function in worldwide company. Enhancing pressure for transparency and compliance will certainly test standard OFC models, prompting a shift towards better liability and adherence to worldwide standards.

The adoption of electronic innovations, consisting of blockchain and man-made intelligence, is anticipated to redefine exactly how OFCs operate. These innovations may boost functional effectiveness and improve conformity systems, allowing OFCs to offer even more transparent and secure solutions. Furthermore, as global investors look for jurisdictions that focus on sustainability and company social responsibility, OFCs will certainly need to adapt by welcoming lasting money principles.

In feedback to these fads, some OFCs are diversifying their service offerings, relocating past tax optimization to consist of wide range monitoring, fintech options, and consultatory services that line up with international finest techniques. As OFCs progress, they have to balance the demand for competitive advantages with the need to satisfy tightening laws. This twin focus will ultimately determine their sustainability and relevance in the worldwide service landscape, ensuring they continue to be important to international financial operations while additionally being responsible company residents.

Conclusion

The influence of Offshore Financing Centres on worldwide company procedures is extensive, offering numerous advantages such as tax efficiencies and streamlined procedures. Nevertheless, the enhancing complexity of conformity demands and heightened regulatory analysis existing considerable difficulties. As international requirements progress, the operational landscape for companies using OFCs is altering, demanding a critical method to make sure adherence. The future of Offshore Money Centres will likely depend upon balancing their inherent benefits with the needs for greater transparency and responsibility.

Offshore Money Centres (OFCs) have actually become pivotal in shaping worldwide organization operations, providing special advantages such as tax obligation optimization and regulatory flexibility.Offshore financing centres (OFCs) serve as essential centers in the international monetary landscape, promoting global company purchases and investment possibilities. On the whole, the use of OFCs can develop a more effective monetary framework, sustaining both functional effectiveness and strategic business goals in a global context.

Browsing the intricacies of compliance in overseas financing centres (OFCs) presents considerable challenges for companies.Current regulatory fads are significantly reshaping the landscape of overseas finance centres (OFCs), engaging services to adjust to an increasingly rigorous conformity setting.

Report this page